Active share calculation

Active share calculates the aggregate holdings difference from a benchmark with no consideration toward the merit riskiness or volatil- ity of the portfolio relative to the. Active management has traditionally been measured by tracking.

Net Asset Value Nav Formula And Nav Per Share Calculation

Active share is a measure of the difference between a portfolios holdings and its benchmark index.

. Active Share for equity funds. The Active Share displayed in this panel is computed relative to the primary benchmark declared in the funds prospectus ie the Prospectus Benchmark. It measures how much or little a funds portfolio holdings diverge from that of its benchmark.

R g 5. The Swedish Investment Fund Association recommends. While conventional wisdom is that top-heavy cap-weighted indices represent more.

How to calculate Active Share. Its members to publish Active Share for equity funds in order to. It is defined as1.

ActiveShare L 1 2 ω d s l bω c l a f k _ p v g. The active share of a mutual fund ranges from zero pure index fund to 100 no overlap with the benchmark. Active Share has the advantage of being conceptually simple.

Thus a portfolio that has. Mathematically it is calculated as the sum of the difference between the weight of. First it appears simple and intuitive.

For each fund Active Share is also. In recent years the investment community has embraced this concept both as a. Active share refers to the percentage of a funds underlying holdings that are different from its benchmark index.

Adopted on May 18th 2015. Active Share can most easily be calculated as 100 minus the sum of the overlapping portfolio weights. Active share is the proportion of a portfolios holdings that is different from the benchmark for that portfolio.

Step 1 Data - Constituents of the portfolio with their weights in the scheme portfolio Step 2 Data - Constituents of the benchmark stocks with their weights in the. Here are some examples to illustrate how Active Share. This is defined as active_share_ij active_share_ji sumN_k omegak_i - omegak_j where N is the number of all stocks that exist in the market omegak_i is the weight of stock k.

Active Share of 76 highlights the importance that the benchmark plays in the Active Share calculation. The greater the active share percentage the more the fund. Active share measures how much an equity portfolios holdings differ from the benchmark index constituents.

Active Share compares the holdings in a fund with the holdings in its benchmark.

16 Key Social Media Metrics To Track In 2022 Benchmarks

Churn Rate How To Define And Calculate Customer Churn Clevertap Clevertap

/stock-market-836262076-94c0b0ab5d2b4b7788fddf178abc0c3d.jpg)

Active Share Measures Active Management

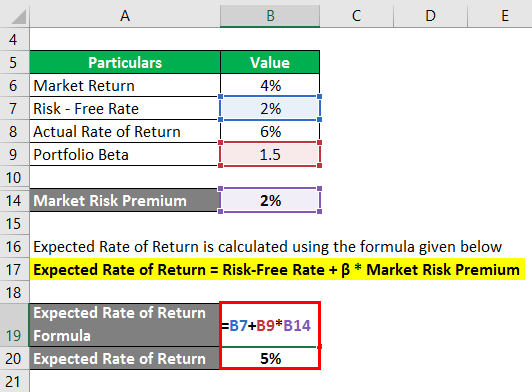

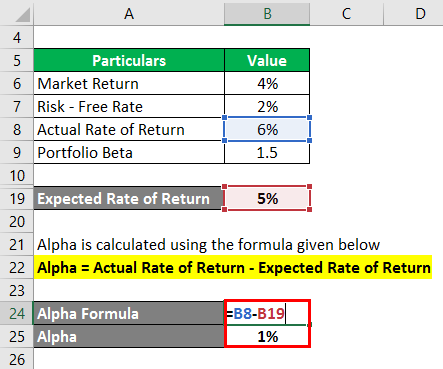

Alpha Formula Calculator Examples With Excel Template

What Startups Should Know About Monthly Active Users Mau Baremetrics

How To Calculate Intrinsic Value Of A Share Various Valuation Methods

Information Ratio Financial Edge

Free Float Market Capitalization Formula How To Calculate

Alpha Formula Calculator Examples With Excel Template

Alpha Formula Calculator Examples With Excel Template

![]()

How To Measure Active Users And Everything You Need To Know

/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

![]()

How To Measure Active Users And Everything You Need To Know

Market Share Formula And Percentage Calculator Excel Template

Activity Ratio Formula And Turnover Efficiency Metrics Excel Template

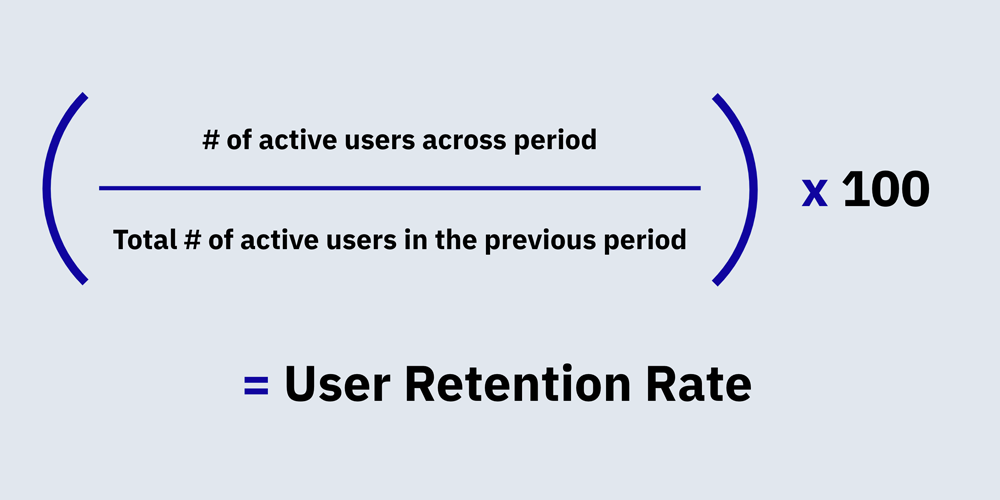

How To Calculate Retention Rate In B2b Saas